Banking CRM in 2026 is no longer about features, dashboards, or automation checklists.

It’s about eliminating fragmentation.

Banks are losing customers not because they lack digital channels, but because those channels operate in isolation. CRM systems that fail to unify these touchpoints are actively damaging customer experience, revenue growth, and compliance readiness.

This is why uni-channel CRM has emerged as the most critical banking CRM trend in 2026.

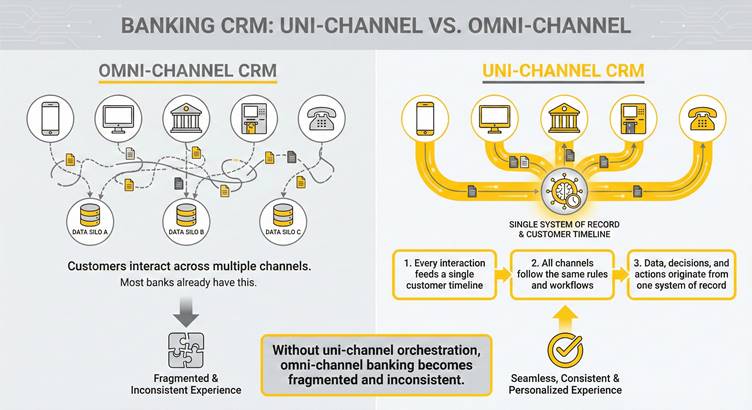

Uni-Channel vs Omni-Channel CRM in Banking

Omni-channel CRM allows customers to interact across multiple channels.

Most banks already have this.

Uni-channel CRM goes further by ensuring that:

- Every interaction feeds a single customer timeline

- All channels follow the same rules and workflows

- Data, decisions, and actions originate from one system of record

Without uni-channel orchestration, omni-channel banking becomes fragmented and inconsistent.

Key Banking CRM Trends Defining 2026

1. Uni-Channel CRM as the Revenue Engine

Modern banks are shifting CRM from a support system to a revenue-driving platform. Uni-channel CRM enables:

- Consistent lead management across digital and physical channels

- Real-time cross-sell and up-sell triggers

- Clear revenue ownership and accountability

FiNASAL advantage: CRM-led sales orchestration with embedded analytics, not disconnected reports.

2. Customer Experience Without Channel Boundaries

Customers expect seamless transitions between mobile apps, call centers, branches, and digital onboarding. Uni-channel CRM ensures:

- No repetition of data

- Full context at every interaction

- Faster resolution and higher satisfaction

FiNASAL advantage: A unified customer behavior graph updated in real time.

3. AI-Driven CRM Requires Unified Data

AI in banking CRM only works when customer data is consolidated. Uni-channel CRM enables:

- Predictive churn analysis

- Intelligent product recommendations

- Automated compliance anomaly detection

FiNASAL advantage: Banking-specific AI models trained on unified customer journeys.

4. Hyper-Segmentation Based on Real Behavior

Static customer segments are obsolete. Banks now require dynamic segmentation driven by:

- Engagement patterns

- Product usage

- Risk and compliance signals

FiNASAL advantage: Real-time segmentation that adapts as behavior changes.

5. Built-In Compliance Across the Customer Journey

Regulators audit journeys, not systems. Uni-channel CRM ensures:

- Complete interaction logging

- Consent and approval traceability

- Seamless AML and KYC integration

FiNASAL advantage: Compliance workflows embedded directly into CRM operations.

Bottom Line: CRM Trends That Actually Matter in 2026

If your banking CRM is not:

- Uni-channel by design

- Driving revenue decisions

- Enforcing compliance

- Operating in real time

Then it is not future-ready.

FiNASAL builds uni-channel banking CRM platforms designed for measurable ROI, operational control, and regulatory confidence.