FiNLean™ Delivery Model: Driving Digital Transformation in Banking with Speed, Precision & Compliance

FiNLean™ Delivery Model: Driving Digital Transformation in Banking with Speed, Precision & Compliance

This eBook introduces the FiNLean™ Delivery Model, FiNASAL’s proprietary framework for delivering high-impact banking and microfinance technology projects. By reading this guide, you will learn how to:

Understand why traditional delivery models (waterfall or pure agile) fail in complex, regulated financial environments.

Discover the systemic challenges banks and MFIs face in technology projects — from compliance failures to integration complexity — and how FiNLean™ mitigates them.

Explore the principles and core values of FiNLean™: Compliance by Design, Predictable Outcomes, Radical Transparency, and Customer-Centricity.

See how the 4 Phases of FiNLean™ (Blueprint & Analysis, Orchestration & Build, Validation & Go-Live, Optimization & Support) de-risk every project.

Learn how compliance and risk management are embedded into every step of the methodology, ensuring audit readiness at all times.

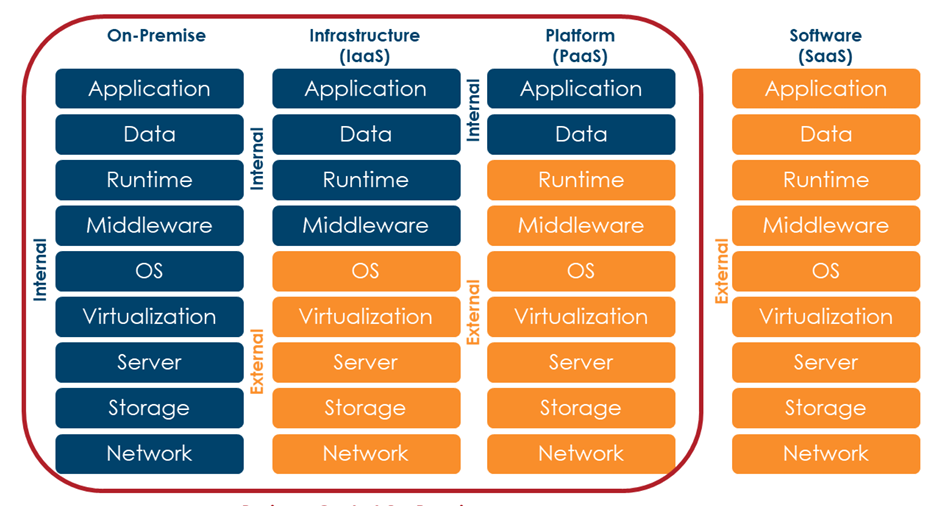

Examine how FiNLean™ integrates seamlessly with Microsoft Dynamics 365, core banking systems, payment gateways, and AML platforms.

Gain insights from real-world case scenarios where FiNLean™ accelerated lending, improved compliance, and enabled scalable digital transformation.

Discover why choosing FiNASAL + FiNLean™ ensures faster time-to-value, secure execution, and long-term business alignment.

Traditional methods fail — rigid waterfall models lack agility, while pure agile lacks governance. FiNLean™ combines the best of both.

Compliance cannot be an afterthought — FiNLean™ makes regulatory alignment a core design principle from day one.

Predictability matters — through phased delivery, risk registers, and governance checkpoints, FiNLean™ ensures projects finish on time, on budget, and fully compliant.

Integration is critical — FiNLean™ treats API-led integration with CRM, core banking, payments, and AML platforms as a core deliverable, not an add-on.

User adoption drives ROI — role-based training and continuous optimization ensure technology investments deliver lasting business value.

FiNLean™ delivers measurable impact — clients experience 30–40% faster time-to-value, reduced compliance risk, and scalable innovation.