Financial services require software that’s not just functional, but auditable, highly available, and built for regulatory scrutiny. FiNASAL’s Application Development & Maintenance (ADM) practice combines deep financial-domain experience with modern engineering — enabling banks and microfinance organizations to modernize, innovate and operate with confidence.

End-to-end ADM for complex environments

We design, build, integrate and operate mission-critical applications across the full lifecycle:

- Custom application development — Tailored web, mobile, and enterprise solutions built around financial workflows, including Dynamics 365 CRM, BPM automation platforms, and ERP systems.

- Application modernization & migration — Legacy replatforming, cloud-native rewrites, and incremental refactoring to future-ready, compliant architectures.

- Application maintenance & support — SLA-driven L1–L3 support, patching, release management, and enhancement work to ensure stability and compliance.

- Integration & middleware — Secure connectors to core banking, payment gateways, ERP, CRM, BPM, AML/KYC systems, and fintech APIs.

- Robotic Process Automation (RPA) — Automating repetitive tasks such as reconciliations, compliance checks, and customer onboarding to reduce cost and errors.

- Quality engineering & test automation — Shift-left testing, automation frameworks, performance, and security validation to ensure reliability.

- DevOps, DevSecOps & SRE — Automated CI/CD pipelines, infrastructure as code, observability, and reliability engineering for secure, continuous delivery.

These capabilities reflect the industry shift toward cloud, AI, automation, and continuous delivery in ADM — the proven approach top providers now use to reduce cost, accelerate time-to-value, and improve compliance readiness.

Why FiNASAL for ADM in financial services

We speak finance first.

Our teams combine financial-domain experience with Microsoft & cloud engineering, so solutions understand your products, risk controls and compliance needs — not just code.

Compliance-by-design.

From day one we embed audit trails, role-based access, encryption and secure logging so your applications are regulator-ready

Reliable delivery at speed.

Our FiNLean™ delivery model (hybrid agile + governance) balances iterative delivery with rigorous control gates so you get predictable scope, cost and regulatory traceability.

Modern engineering & operations.

We combine test automation, observability, automated compliance checks and SRE practices to reduce incidents and shrink mean-time-to-repair. This is the next-gen ADM approach used by leading global providers.

Our ADM approach — practical, secure, auditable

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vivamus vel nisl nec turpis dapibus vulputate id at massa.

1. Discover & Blueprint

We start with rapid discovery: business flows, data maps, integration points, compliance requirements and operational SLAs. The outcome is a formal blueprint (functional + non-functional requirements) and migration/roadmap plan.

3. Build with Quality & Security (DevSecOps)

• Agile sprints with automated unit, integration and regression testing. • Security checks embedded in pipelines (SAST, DAST, dependency scanning). • Feature flags and canary releases for safe rollout.

2. Design & Secure Architecture

Architecture that balances performance, security and operability: modular microservices where appropriate, secure APIs, data partitioning for residency/privacy, and a clear CI/CD and rollback strategy.

4. Integrate & Validate

Seamless integrations with core banking, payment rails, AML/KYC, regulatory reporting endpoints and analytics platforms. Comprehensive UAT, compliance validation and load/resilience testing before go-live.

5. Operate, Observe & Improve

Production runbooks, SRE playbooks, 24/7 NOC & SOC handoffs, end-to-end observability (metrics, logs, traces) and continuous improvement cycles based on telemetry. This lifecycle mirrors best-in-class ADM practices that prioritize automation, observability and security across the application lifecycle.

Core technical capabilities

- Cloud & hybrid platforms: Azure-first (trusted cloud regions, data residency), container orchestration (AKS), serverless patterns.

- Modern architectures: Microservices, domain driven design, event-driven integration.

- CI/CD & IaC: Pipelines, automated testing, Terraform/ARM/Bicep for repeatable environments.

- DevSecOps: Automated security scanning, compliance gating, policy as code.

- Observability & SRE: Centralized telemetry, incident runbooks, SLO/SLA management and post-incident reviews.

- Data & analytics: Secure data pipelines, Power BI integration, ML model deployment for scoring & decisioning.

Compliance & Security — built in, not bolted on

Financial institutions operate under tight regulatory scrutiny. Our ADM engagements include:

- Security controls aligned to SAMA, NIST and ISO27001 standards.

- Secure SDLC with mandatory security gates and audit trails.

- Data residency & privacy options to host within approved regions or hybrid models.

- Penetration testing & third-party audits as part of release readiness.

We maintain vendor governance artifacts and evidence packages to simplify audits and regulator reviews.

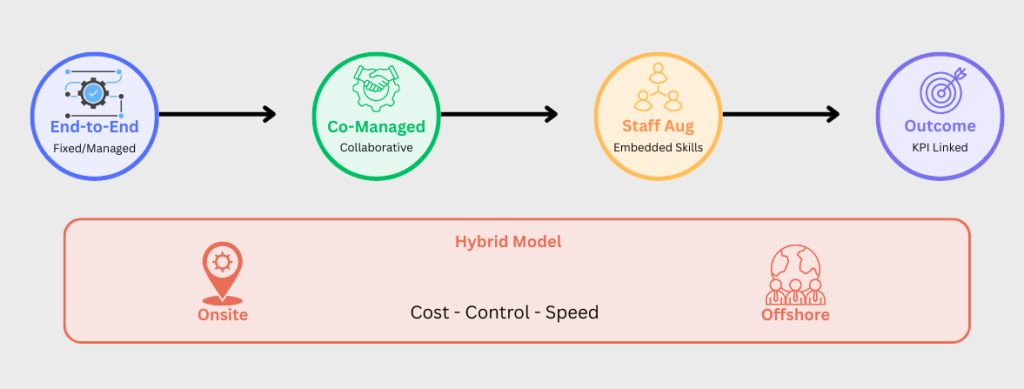

Delivery models — choose what fits your organization

- End-to-end ADM (Fixed/Managed) — FiNASAL owns delivery and ongoing operations under SLAs.

- Co-managed ADM — We operate alongside your teams, handing over runbooks and governance.

- Staff augmentation — Skilled Dynamics 365, cloud, security and integration engineers embedded in your teams.

- Outcome-based engagement — Milestone or KPI-linked delivery for specific business outcomes.

Our hybrid onsite-offshore model provides local presence for governance and faster time-to-market via offshore Centers of Excellence. This is the delivery pattern adopted by market leaders to balance cost, control and speed.

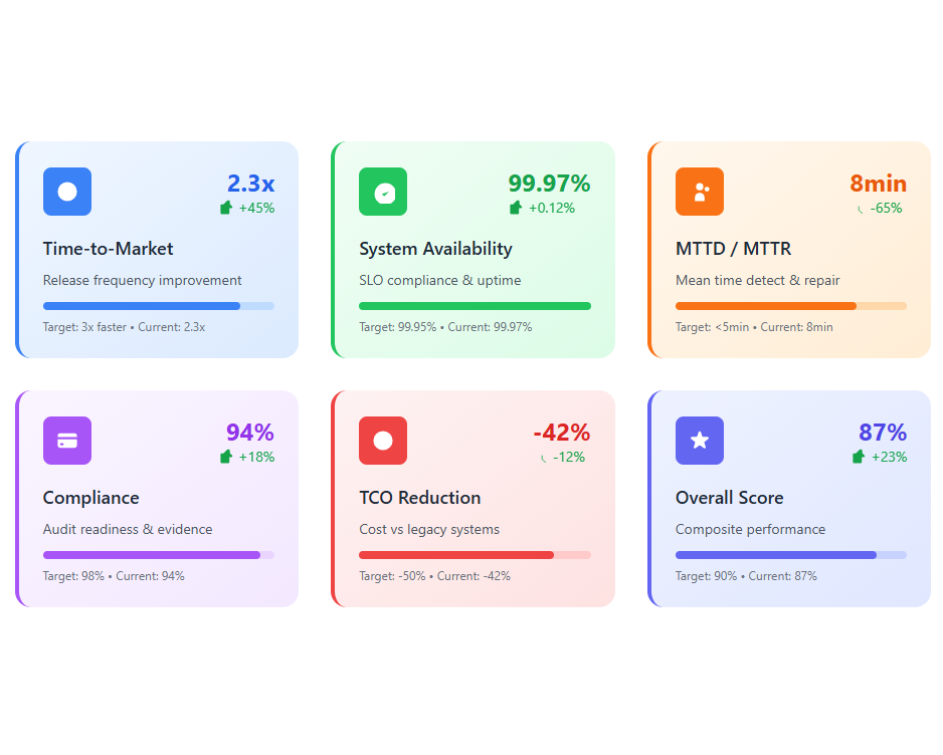

Quality & measurable outcomes

We measure success by business metrics, not just code completed:

- Time-to-market for new features (release frequency)

- System availability and SLO compliance (uptime)

- Mean time to detect & repair (MTTD / MTTR)

- Compliance & audit readiness (evidence packages)

- Cost of ownership (TCO reduction vs legacy)

Our engineering and operations practices are designed to improve these metrics continuously — echoing findings from industry ADM benchmarks that emphasize automation, cloud and AI-enabled testing to realize cost & speed gains.

Typical engagements — example use cases

- CRM & Digital Lending Platform: End-to-end Dynamics 365 implementation integrated to core banking and credit bureaus, with automated KYC and decisioning pipelines.

- Core Modernization: Incremental refactor/migration of legacy services to cloud-native infrastructure with SRE handover.

- Managed Application Services: 24/7 support, patching, security monitoring and continuous delivery for high-transaction applications.

- AI-embedded Features: Deploy predictive scoring and chatbot assistants integrated into CRM and contact center operations.

(If you’d like, we can provide anonymized references and a detailed case study appropriate for your review.)

Why FiNLean™ Makes ADM Different

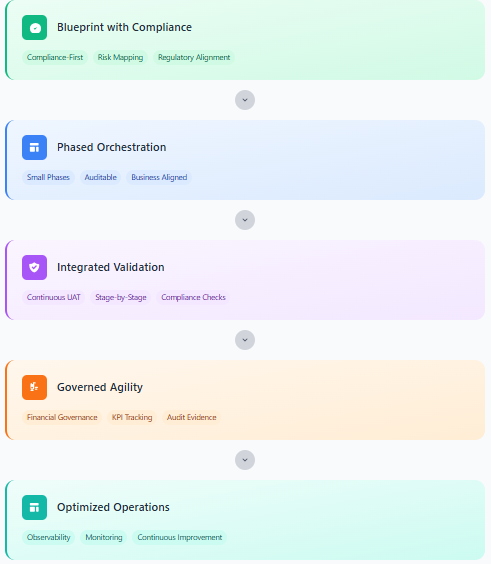

Most ADM providers focus on agile speed. FiNASAL goes further: FiNLean™ is a hybrid agile model designed for financial institutions.

Key differentiators FiNLean™ brings to ADM:

- 🔹 Blueprint with Compliance — every ADM project begins with a compliance-first blueprint that maps workflows, risks, and regulator expectations.

- 🔹 Phased Orchestration — instead of long delivery cycles, we break work into small, auditable phases aligned with business priorities.

- 🔹 Integrated Validation — continuous user acceptance testing (UAT) and compliance checks, not just at the end, but at every stage.

- 🔹 Governed Agility — agile sprints with built-in financial governance — budgets, KPIs, and audit evidence are tracked transparently.

- 🔹 Optimized Operations — handover to our managed services team with observability, monitoring, and continuous improvement already embedded.

This marriage of agile speed with regulatory discipline is what sets FiNASAL apart from global competitors who often miss the nuance of financial services delivery.

Why partner with FiNASAL

Domain-first engineering

We align technology to financial processes, regulatory needs and business KPIs.

FiNLean™ delivery

Hybrid agile with governance—faster, predictable, and audit-friendly.

Microsoft & Azure expertise

End-to-end Dynamics 365, Power Platform and Azure implementations.

Security posture

Compliance-by-design for SAMA, PCI and ISO standards.

Operational excellence

We turn projects into stable, measurable platforms with SRE and observability at the core.

Ready to modernize, secure and operate your critical applications with confidence? Contact FiNASAL for a complimentary ADM readiness assessment. We’ll map your application estate, identify quick wins, and propose a FiNLean™ roadmap that balances speed, cost and compliance. Request a Free ADM Assessment

Frequently Asked Questions

Unlike generic IT vendors, FiNASAL combines financial-domain expertise with modern engineering. Our proprietary FiNLean™ Delivery Model ensures faster delivery, predictable budgets, and compliance-first outcomes — a unique fit for financial institutions yet equally works for all organizations needing quality, agility and resilience in the solutions delivery.

Yes, our strengths in CRM, ERP, BPM, AI, and RPA make us adaptable across verticals While our primary focus is banks, microfinance, and fintechs, we also support other complex and regulated industries

Yes. We offer end-to-end services: from custom development and modernization to 24/7 SLA-driven support, monitoring, and enhancement. Many clients choose us to manage the entire application lifecycle.

Compliance is built in, not bolted on. Every ADM engagement includes role-based access, audit trails, encryption, secure DevSecOps pipelines, and regulator-ready evidence aligned with standards like SAMA, ISO27001, and PCI-DSS.

Absolutely. We specialize in replatforming legacy applications into cloud-native, API-first architectures. Our phased modernization approach reduces risk while ensuring continuity of critical financial operations.

Yes. We provide secure integration and middleware services that connect CRM, ERP, BPM, AML/KYC, payment gateways, and third-party fintech APIs — ensuring smooth data flow across your ecosystem.

We leverage a hybrid onsite–offshore model to give you the best of both worlds: local governance for control and offshore Centers of Excellence for speed and cost efficiency.

We embed RPA and AI into applications to automate routine tasks, improve compliance reporting, and deliver predictive insights — helping financial institutions reduce costs and serve customers faster.

Our job doesn’t end at deployment. With SRE practices, observability dashboards, and managed support services, we ensure applications run reliably, securely, and continuously improve over time.

You can start with a free ADM readiness assessment, where we map your current applications, identify quick wins, and propose a tailored FiNLean™ roadmap for your institution.