Introduction

The financial world is in the midst of a seismic shift. For years, banks and financial institutions leaned on legacy systems as their trusty foundation. But today, these outdated systems are more like anchors, dragging down innovation and slowing progress. Manual processes, disjointed data, and rigid infrastructure struggle to keep pace with tech-savvy customers and nimble competitors.

Enter Microsoft Dynamics 365—a game-changer for institutions ready to break free from the past and embrace a future of agility and innovation.

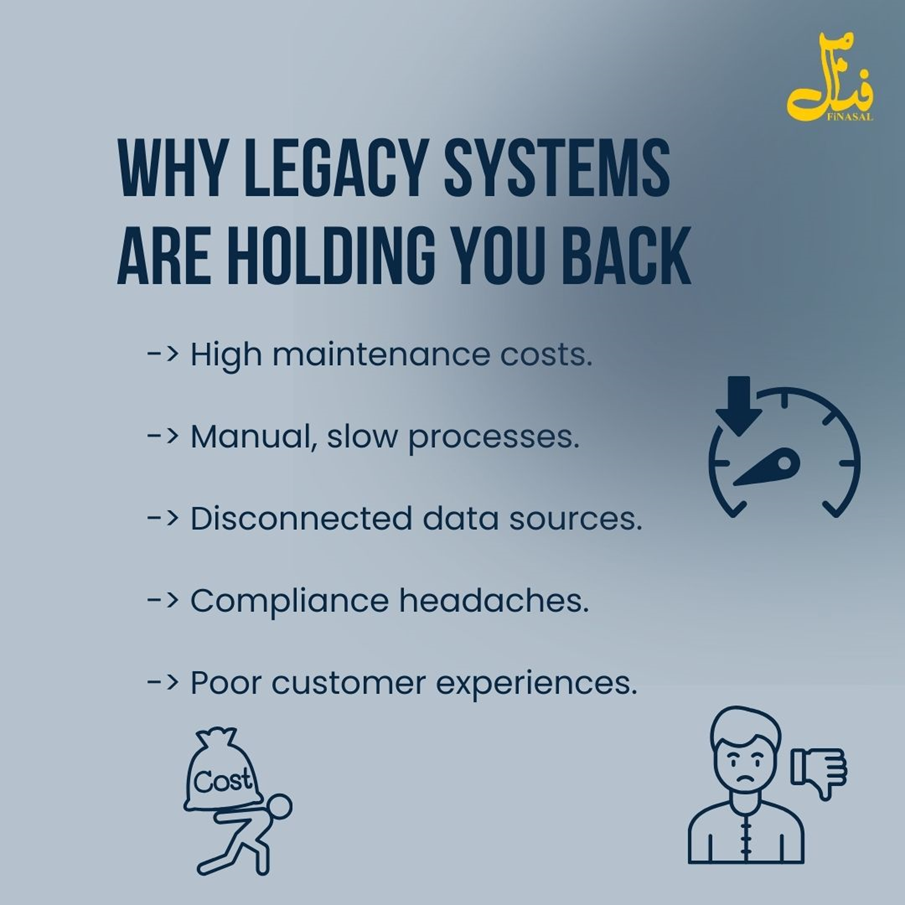

Legacy Systems: The Silent Burden of Sticking with the Status Quo

For decades, financial firms leaned on custom-built or siloed systems to keep operations running. These systems were once reliable workhorses, but now they’re holding institutions back. The risks are real:

- Skyrocketing maintenance costs that drain budgets

- No access to real-time data or actionable insights

- Compliance updates that feel like navigating a maze

- Limited ability to scale with growing demands

- Customer engagement that feels impersonal and disconnected

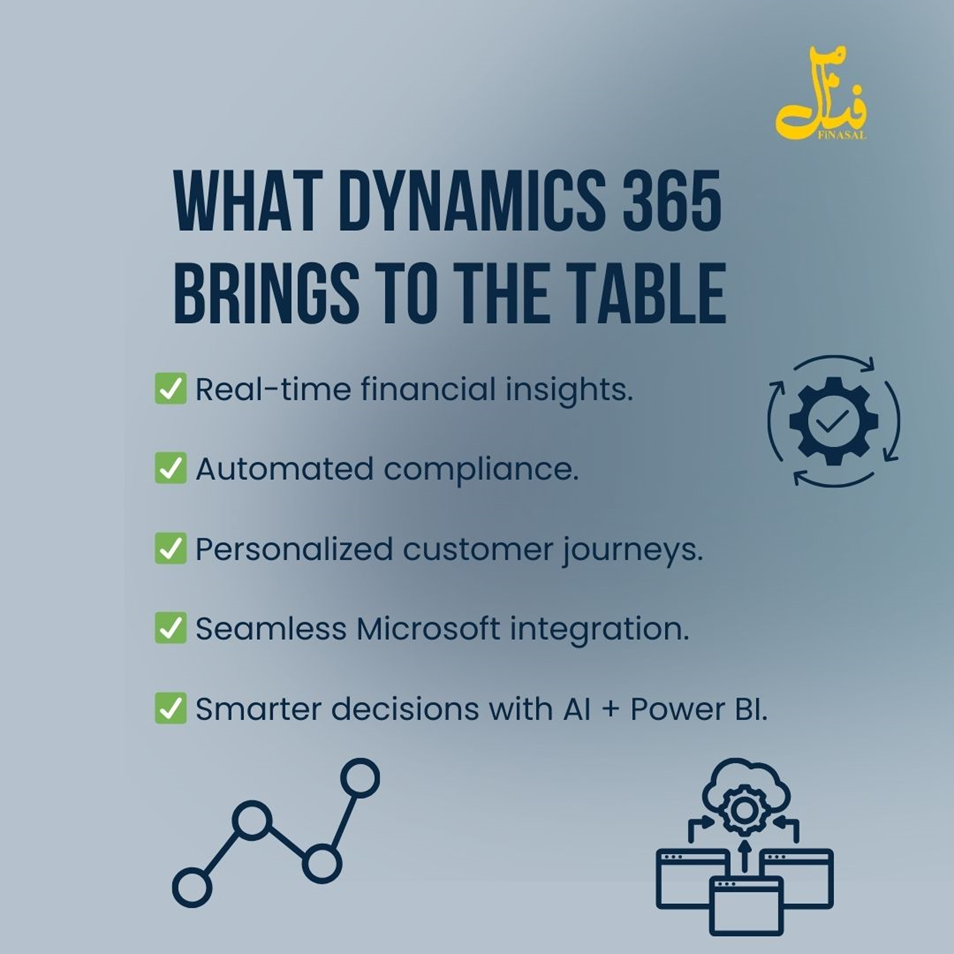

What Is Microsoft Dynamics 365?

Microsoft Dynamics 365 is a powerful suite of cloud-based business applications that blend CRM and ERP capabilities. Built on the secure, scalable Azure platform, it empowers financial institutions to unify their data, streamline operations, stay compliant, and deliver personalized customer experiences that feel human.

Key modules for financial institutions:

- Dynamics 365 Finance: Streamlines budgeting, forecasting, and financial operations

- Dynamics 365 Customer Insights: Unlocks deep customer understanding

- Dynamics 365 Sales: Boosts cross-selling and client relationships

- Power BI + AI integration: Turns raw data into actionable insights

5 Ways Dynamics 365 Is Transforming Financial Institutions

1. Real-Time Financial Clarity

With Dynamics 365 Finance, your team gets a single source of truth. Automated reports, centralized data, and AI-driven forecasting make budgeting, cash flow tracking, and decision-making faster and smarter.

2. Compliance Without the Headaches

Say goodbye to manual spreadsheet nightmares. Dynamics 365 automates compliance updates, tracks audit trails, and ensures regulatory reporting is always on point—whether it’s IFRS, GDPR, or SOX.

Example: A regional bank slashed compliance reporting time by 50% using Dynamics 365’s automated tools.

3. Customer Experiences That Feel Personal

Integrated CRM features let you dive deep into customer behavior, segment clients, and offer tailored financial products. It’s like having a personal financial advisor for every client, at scale.

4. Automation That Feels Effortless

From onboarding new clients to processing loans, managing risks, and detecting fraud, Dynamics 365 automates workflows so your team can focus on what matters—building relationships and driving growth.

5. Seamless Integration with Tools You Already Love

Dynamics 365 plays nicely with the Microsoft ecosystem—think Teams, Outlook, Excel, SharePoint, and Power Platform. Build custom apps, automate processes, and keep your team in sync without missing a beat.

Case Study: A Digital-First Bank’s Leap Forward

Picture a mid-sized bank bogged down by legacy software and endless manual processes. They made the leap to Dynamics 365, transforming their operations into a fully integrated, cloud-first powerhouse.

Results:

- Loan approvals sped up by 40%

- Operational efficiency soared by 30%

- Compliance accuracy hit 99%

- 360-degree customer views unlocked new cross-selling opportunities

Why Now Is the Moment to Act

Every day spent clinging to legacy systems widens the gap between traditional banks and fintech trailblazers. Dynamics 365 offers a cloud-first, AI-powered path to:

- Agility to adapt to change

- Ironclad security for peace of mind

- Scalability to grow without limits

- A competitive edge to outshine disruptors

Conclusion: From Legacy to Leading Edge

The future of finance doesn’t belong to those who wait — it belongs to those who act. Microsoft Dynamics 365 isn’t just a new tool; it’s a gateway to reimagining how your institution operates, connects, and competes in a rapidly changing financial ecosystem. Modern clients expect speed, transparency, and personalization. Regulators demand accountability and precision. And markets shift faster than ever. Sticking with legacy systems is more than a technical limitation — it’s a strategic risk.

Ready to transform? Visit FiNASAL’s website to explore tailored digital solutions that fuel financial innovation.